irs child tax credit problems

All those various payments coming to eligible taxpayers can get. Advance child tax credit payments.

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Yesterday the IRS updated its Fact Sheet on the Child Tax Credit with additional information on reconciling the credit.

. Sarah TewCNET Monthly advance child tax credit payments have now ended in the US with roughly 93 billion disbursed. If you claimed married filing joint status on the tax return. From July through December 2021 advance payments were sent automatically to taxpayers with qualifying children who met certain criteria.

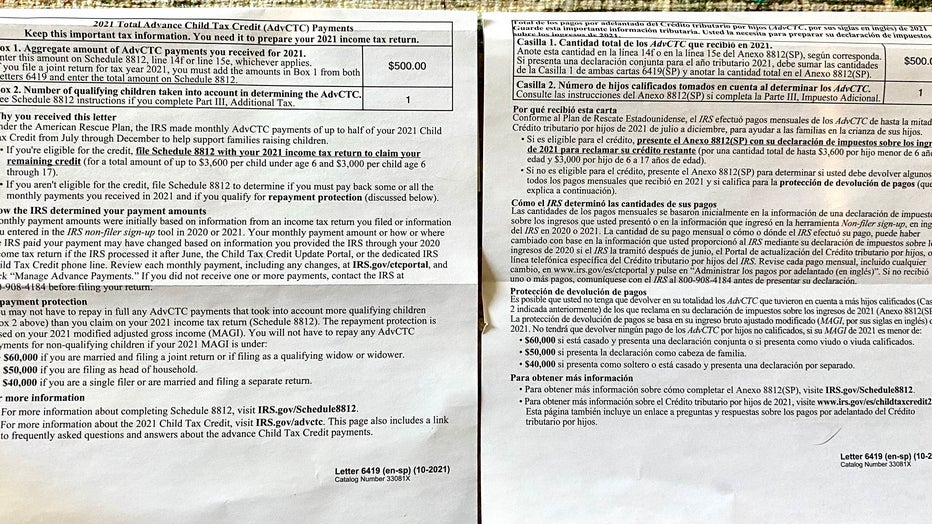

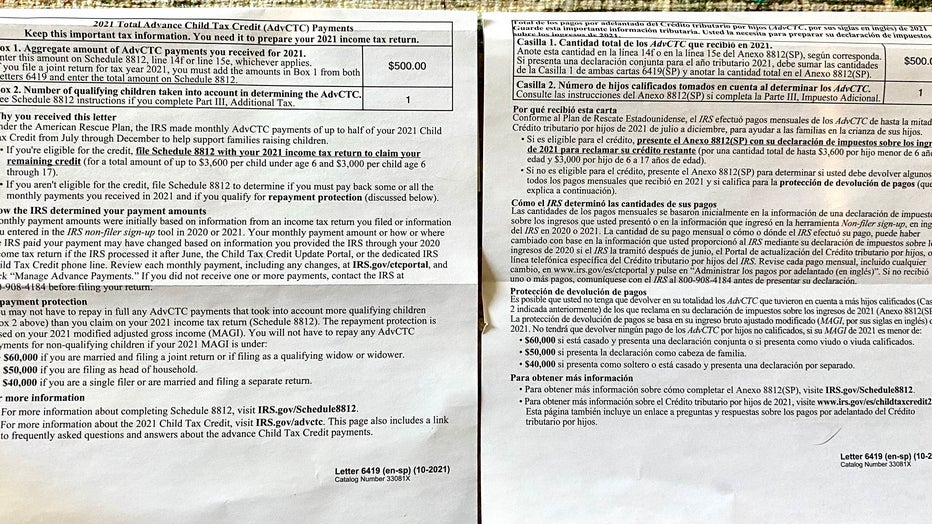

Advance Child Tax Credit CTC A word of caution to all married parents filing a joint return for tax year 2021 who received advance Child Tax Credit CTC payments in 2021. Why IRS Letter 6419 is critical to filing your 2021 taxes and the child tax credit. IR-2020-248 November 2 2020 The Internal Revenue Service today announced a number of changes designed to help struggling taxpayers impacted by COVID-19 more easily settle their tax debts with the IRS.

Unlike last year a special tax break doesnt exist for up to. The Internal Revenue Service said it is reviewing complaints by some taxpayers who say that the IRS Letter 6419 sent to them spells out the wrong dollar amount for what the families received in 2021 for the advance payments of the child tax credit which were issued each month from July through December. Will unemployment benefits come with a tax break in 2022.

DONT THROW THIS IRS DOCUMENT AWAY. You must combine the total amounts shown in box 1 of both IRS Letters 6419 when you file your federal income tax return this year. The advance child tax credit payments were early payments of up to 50 of the estimated child tax credit that taxpayers may properly claim on their 2021 returns.

The IRS is still processing some 2020 Individual tax returns and amended tax returns on top of continuing to issue the third round of Economic Impact Payments EIP3 all while also starting a new program to provide Advance Payment of the Child Tax Credit AdvCTC this year. The IRS took this step after acknowledging that the letter it. Outdated IRS info can lead to missing or incorrect child tax credit payments.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

How The New Expanded Federal Child Tax Credit Will Work

Advance Child Tax Credit Filing Confusion Cleared Up

2021 Child Tax Credit Advanced Payment Option Tas

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Stimulus Checks Child Tax Credit Stimulus Check Info Available From Irs

Child Tax Credit Dates As Irs Set To Send Out New Payments

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

Study Claims Parents Will Quit If Child Tax Credit Payments Are Extended Does Stimulus Hurt Labor Fingerlakes1 Com

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Will You Have To Repay The Advanced Child Tax Credit Payments Wdtn Com

Irs Issues Confusing Advice On Reconciling The Child Tax Credit

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Did Your Advance Child Tax Credit Payment End Or Change Tas

Advance Payments Of The Child Tax Credit I M Definitely Eligible Why Does It Says I M Not R Irs

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block